When it comes to working from home, many people are curious about the financial benefits. Some people may be wondering if they can make as much money as they would if they were working in an office. Others may be curious about the tax implications of working from home.

Studies shows, working from home typically saves you up to $4,000 to $10,000 per year and this number is increasing.

With inflation just around the corner and a lower average salary for a certain age group, working from home saves you from many expenses that are required if you are working in an office setting.

Financial Benefits of Working From Home For Employees

One in four employees works from home at least some of the time, and for good reason. Working from home offers a number of benefits that you will not experience if working in the office.

Here are some of the main financial benefits of working from home for employees.

1. Less Commute, Less Fuel

Fuel cost is expensive, and if you are working from home. Commuting less will eventually help you save on your expenses on fuel.

According to a study to understand the reasonable commuting distance to work, on average, 9 in 10 workers commute 18.8 miles (30.26km) to work each way, with 2.96% of the commuters traveling more than 50 miles (80.47km) to work each way.

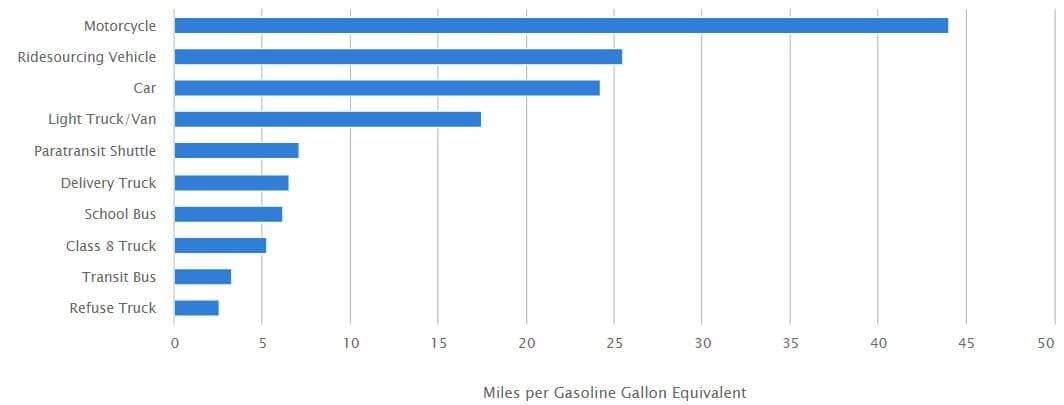

According to the Alternative Fuel Data Center (AFDC), a car can travel on average 24.2 miles per gallon of fuel.

If you get 24.2 miles per gallon of fuel on an average price of $2.50 per gallon, you’ll spend on average $1,009.92 just on fuel.

| No. of Miles | Per Trip | Round Trip | Per Week | Per Month | Per Year |

|---|---|---|---|---|---|

| 5 | $0.52 | $1.03 | $5.17 | $20.66 | $268.60 |

| 10 | $1.03 | $2.07 | $10.33 | $41.32 | $537.19 |

| 15 | $1.55 | $3.10 | $15.50 | $61.98 | $805.79 |

| 18.8 | $1.94 | $3.88 | $19.42 | $77.69 | $1,009.92 |

| 20 | $2.07 | $4.13 | $20.66 | $82.64 | $1,074.38 |

| 30 | $3.10 | $6.20 | $30.99 | $123.97 | $1,611.57 |

| 40 | $4.13 | $8.26 | $41.32 | $165.29 | $2,148.76 |

| 50 | $5.17 | $10.33 | $51.65 | $206.61 | $2,685.95 |

2. Lower Car Insurance

Lowering the number of miles you put on your car each year could help you save money on your car insurance premium. Most insurance companies offer discounts for drivers who use their vehicles less.

Care insurance is generally priced differently depending on the primary use of your car, pleasure, or commute.

What is the difference between a car used for pleasure or commute

Pleasure cars are typically insured for the use of pleasure activities, not used for business purposes, and are not driven to or from work. Commuting cars are typically insured for use in traveling back and forth to work. The car may be used for business purposes and may be driven to and from work.

If the distance of your commute changes and you are commuting less than a certain mile per year, you will be considering using your car for pleasure which can have a lower premium than a car used for commuting. Talking with your insurer can help you save money.

Factors that can influence the cost of your premium:

- Job and occupation

- The lifestyle which you adapt

- Age and gender

- The location where you reside

- Driving history

- Type of vehicle, its age, model, and general condition.

On average you will be quoted $11 less per year for your car insurance policy if it is a pleasure car than a commuter car.

The amount of the discount varies by company, but it can be as much as 10 percent. In some cases, you may even be able to get a discount if you insure multiple cars with the same company.

3. Less Money Spend on Dining Out

Not being in an office environment, you may be less likely to go out to lunch or dinner.

When you work from home, you have the opportunity to save money by cooking your own meals which can be healthier and more nutritious.

Instead of spending money on expensive lunches out, you can prepare a creative and affordable meal in your own kitchen.

By preparing your own food at home, you can save a significant amount of money each month.

According to CreditDonkey, a person who is on a “moderate” budget spends over $252 per month and a whopping $3,000 per year on eating out.

| Family Size | Weekly Expenses | Monthly Expenses | Yearly Expenses |

|---|---|---|---|

| 1 | $63 | $252 | $3,024 |

| 2 | $126 | $504 | $6,048 |

| 3 | $189 | $756 | $9,072 |

| 4 | $252 | $1,008 | $12,096 |

| 5 | $315 | $1,260 | $15,120 |

| 6 | $378 | $1,512 | $18,144 |

| 7 | $441 | $1,764 | $21,168 |

4. Less Money Spending on Clothes

Working from home has many benefits, one of which is spending less money on clothes.

When you work from home, you have the ability to wear whatever you want as there’s no need to dress up in order to impress your boss or coworkers.

You can also avoid buying expensive clothing just to fit in with the corporate culture.

Nonetheless, if you are having a hybrid work arrangement, understanding what to wear for work can help you in your career.

5. Save on Childcare

Childcare can be a huge expenditure if you have small children in your family. If both you and your spouse need to get to the office to work and are not available at home to take care of the kids, paying thousands of dollars for childcare is probably part of your essential family expenses.

According to a survey performed by YouGov on behalf of BankRate for 3,499 parents with young kids, families across the United States spend an average of $8,355 a year for each child to be in childcare.

While ChildCare Aware reported married couples to spend approx. 10% of the household income is on childcare, while single parents spend about 34% of their income.

By working from home, parents can reduce their child-related expenses by 25% to 50%, which is a potential savings of $2,089 to $4,178.

6. Time is Money

You know the saying, “time is money?” Well, that’s especially true when it comes to the time saved from commuting for working from home compared to working in the office.

An average worker spends 27.6 minutes each trip and up to 10 days per year commuting to work.

If you are working in the office, you’ll need to spend time driving to and from work. Not only you are not getting paid to commute to work, getting stuck in the traffic gives you less time to do anything else.

Working from home can help you save time. When you’re not wasting time commuting to and from work, you have more opportunities to work on your own schedule and get more things done.

You are not paid for the time you’ve spend travelling

If your working hours are 8 hours and traveling time is 1 hour, you are actually spending 9 hours doing the work-related tasks but paid for 8 hours of work.

By working from home, you saved the time required for commuting.

You spend less time doing work-related tasks, which increases your “real” hourly wages.

What if the amount of time saved from communting to work is converted to money?

Since an average worker spends 27.6 minutes each trip and 55.2 minutes each day commuting, depending on your hourly wage, you can potentially “earn” thousands of dollars more per year.

The current minimum wage in the United States is $7.25 per hour, using this as a base when you save 1 hour traveling to work, you’ve “earned” $7.25 extra on that day. In a year, you can potentially “earn” more than $1,734.20.

Here is a simple table on the amount of money you can potentially “earn” if you do not need to commute to work relative to your hourly wage.

| Hourly Wage | Daily Earning | Weekly Earning | Monthly Earning | Yearly Earning |

|---|---|---|---|---|

| $5.00 | $4.60 | $23.00 | $92.00 | $1,196.00 |

| $7.25 | $6.67 | $33.35 | $133.40 | $1,734.20 |

| $10.00 | $9.20 | $46.00 | $184.00 | $2,392.00 |

| $15.00 | $13.80 | $69.00 | $276.00 | $3,588.00 |

| $20.00 | $18.40 | $92.00 | $368.00 | $4,784.00 |

| $25.00 | $23.00 | $115.00 | $460.00 | $5,980.00 |

| $30.00 | $27.60 | $138.00 | $552.00 | $7,176.00 |

7. Get Tax Breaks

Depending on where you stay, and the tax laws of your state and country. If you’ve set up part of your home as a home office that is used exclusively for business, a freelancer who is self-employed. You may be eligible for a variety of tax breaks such as,

- Home insurance.

- Mortgage interest.

- Property taxes.

- Home office expenses.

- Depreciation of equipment.

You can understand more about the tax breaks and tax relief from official resources such as the government’s websites:

- United States: Government Tax Credits and Deductions

- Canada: Government of Canada Income Tax

- Singapore: Inland Revenue of Singapore

- Australia: Australian Taxation Office

- United Kingdom: Income Tax

In order to qualify for these deductions, you must meet certain requirements, thus getting advice from your personal financial advisor or lawyers if you need any professional help or advice.

Here are some other recommended reads that may interest you!

- How to Become a Remote Developer: Your Complete Guide to a Digital Nomad Career

- How to Become a Blockchain Developer: Complete Guide to a Career in Blockchain Technology

- How to Become a SQL Developer: Complete Guide to a Career in Database Development

- How to Become a Freelance Travel Writer (Step-by-Step Guide)

- How to Become a Remote Freelance Technical Writer (Step Guide)

Join over 11,000+ achievers who are committed to achieving their career goals!